Posts Tagged ‘Frugal Living’

Frugal Living: 17 Ways to Cut Holiday Spending

It’s November and many have their eyes set on Christmas; the parties, the outings, the gift giving, the food. With the economy still so uncertain and many still without jobs this season may have the air of being a not so merry holiday.

But, it doesn’t have to be that way. With some careful planning and a few creative “outside-of-the-box” ideas you and your family won’t miss the hectic fast paced rush of previous years. In fact, you may come to treasure a slower paced holiday that allows you to reflect and appreciate the true meaning of the season. Check out our 17 ideas and choose a few to incorporate into your celebration this year, and make it through the holidays without breaking the bank or your spirit. Read the rest of the story »

Frugal Living – Saving On Electricity

Electrifying Ideas to Control Your Use of Electricity

To save on electricity, pay close attention to the biggest users. You’ll save more electricity (and money) by dealing with the biggest electricity-guzzlers first rather than worrying about whether it’s better to boil a cup of water on an electric burner or in a microwave. With that in mind, concentrate on your BIG energy users, which are:

Heating, Air Conditioning, Lighting, Washers, Dryers, Refrigerator, Water Heater

As we mentioned earlier, raising or lowering the thermostat will go a long way to reducing your electric bill. So, let’s look at the rest of the list.

Lighting: For appliances or electronics that are close together, plug them into a power strip. That way you can turn them all off at once when not in use.

For areas, like stairways or dark hallways, where you want a light on all the time use lower wattage bulbs. A 15-watt bulb can reduce electricity by 80% over a 75-watt bulb.

Place lamps in corners where their light can bounce off the walls and be more effective.

And, of course, use energy-efficient compact fluorescent light (CFL) bulbs when ever possible.

Washers: To save on water and electricity run only full loads of dishes and let them air dry. The same holds true for laundry. Wash only full loads and dry using a clothesline.

Washing in cold water and using a cold water detergent will also save on the cost of heating water.

Clothes Dryer: If clotheslines are not your thing or if they are not allowed in your area use the moisture sensor option so the dryer turns off automatically when clothes are dry.

Make sure that dryer loads are not too small or too big for the dryer capacity. And, remember to empty the lint trap after each load. This will help the dryer to work more efficiently.

Refrigerator/Freezer: Routinely vacuum condenser coils. Dirty coils affect the efficiency of the compressor which translates to increased electric cost.

Do not place uncovered liquids in refrigerators. Not only do they absorb undesirable flavors, liquids give off vapors that add to the compressors workload.

Additional freezers or refrigerators should be kept in the house or basement when ever possible, not the garage. The fluctuations in winter and summer temperatures make these appliances work harder which in turn uses more energy.

Water Heater: You can reduce your water heating bill by 10% by lowering the water heater temperature from 140°F to 120F°. (Keep the temperature at 140°F if you use an older dishwasher though. This helps sanitize the dishes)

Once a year, drain a bucket of water from the bottom of the water heater tank. This gets rid of sediment, which can waste energy by “blocking” the water in the tank from the heating element.

Insulating your hot water supply pipes will reduce heat loss. (Hardware stores sell pipe insulation kits.)

For older water heaters, consider buying a water heater insulation kit, which reduces the amount of heat lost through the walls of the tank.

Click here for more energy savings tips.

![]() photo credit: bigandyherd

photo credit: bigandyherd

Living Frugally. Living Fabulously.

Being Frugal Today May Not Be A Choice.

From the day we are born we are fed the idea that we must spend money to be happy, buy to be content. But, is that really true? Are we happier spending money we may not have? Are we more content when we have maxed out our credit cards or depleted our bank accounts?

Our current economic times, with the weight of consumer debt, skyrocketing foreclosures and job layoffs say we’re not. Many have come to realize that spending money wildly, without taking the time to consider each purchase has brought us to where we are today. But, what do we or can we do about it? It is so ingrained in us that we must have what the neighbors have, wear what the celebrities wear and buy what the television ads tell us to buy. How do we change?

Simply put – we change – slowly, deliberately, consciously, and over time. We change the way we think about money and spending and having; money we may not have; spending where we don’t need to; and having what we think we need, but really only want. Change can be scary and the steps daunting, but they can also bring us a great deal of freedom and contentment. Not to mention money.

There are hundreds of books and articles on frugal living out there. Plus loads of information about how to reduce your life and cut out the things you like to do. These books and articles tell you how to creatively do without.

But I’m not going to tell you that. In the next few articles, I’m going to detail the same plan that has worked for me—and for friends who’ve asked me to reveal how I live with abundance, even though I’m a single Mom on a limited income. These are my tricks to living what I think is a great life full of interesting activities, culture, art, music, hobbies, and good food. So, check back often to find out how I’ve been able to eat well, entertain, enjoy concerts and plays and art exhibits without breaking the bank. I think you’ll find some helpful hints and few surprises too. Read the rest of the story »

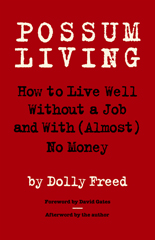

Frugal Living: Living Well Without a Job and With (Almost) No Money

Looking to bypass the money economy? By adopting “possum living,” it is possible to get the good things in life without having to go to a boring, meaningless, frustrating job to get the money to buy them.

Looking to bypass the money economy? By adopting “possum living,” it is possible to get the good things in life without having to go to a boring, meaningless, frustrating job to get the money to buy them.

It brings new meaning to Frugal Living.

In this excerpt from Possum Living: Living Well Without a Job and With (Almost) No Money, Dolly Freed shares why she decided to shun the rat race and live off the land on a half-acre lot outside Philadelphia.

Originally published in the late 1970s when Freed was 18 years old, Possum Living is part philosophical treatise, part down-to-earth how-to, and provides a no-nonsense approach on how to beat the system and be self-sufficient — right in suburbia.

Recent comments

Aenean nonummy hendrerit mauris. Phasellus porta.